travel nurse salary taxes

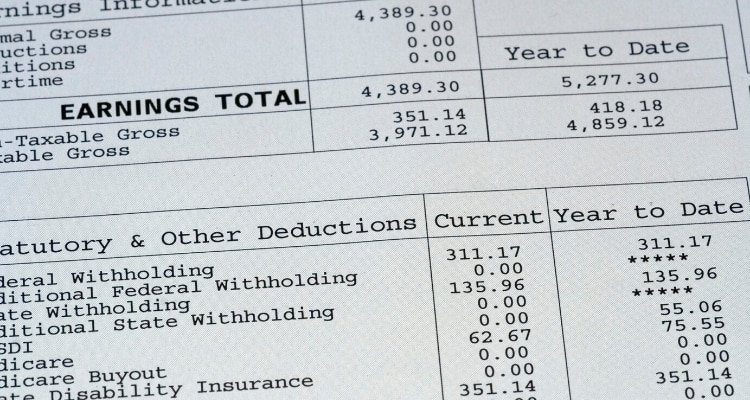

1099 employees expecting to owe over 1000 in taxes have to file and pay taxes quarterly whereas W2 employees have taxes withheld every pay period but only have to file annually. Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and other travel expenses.

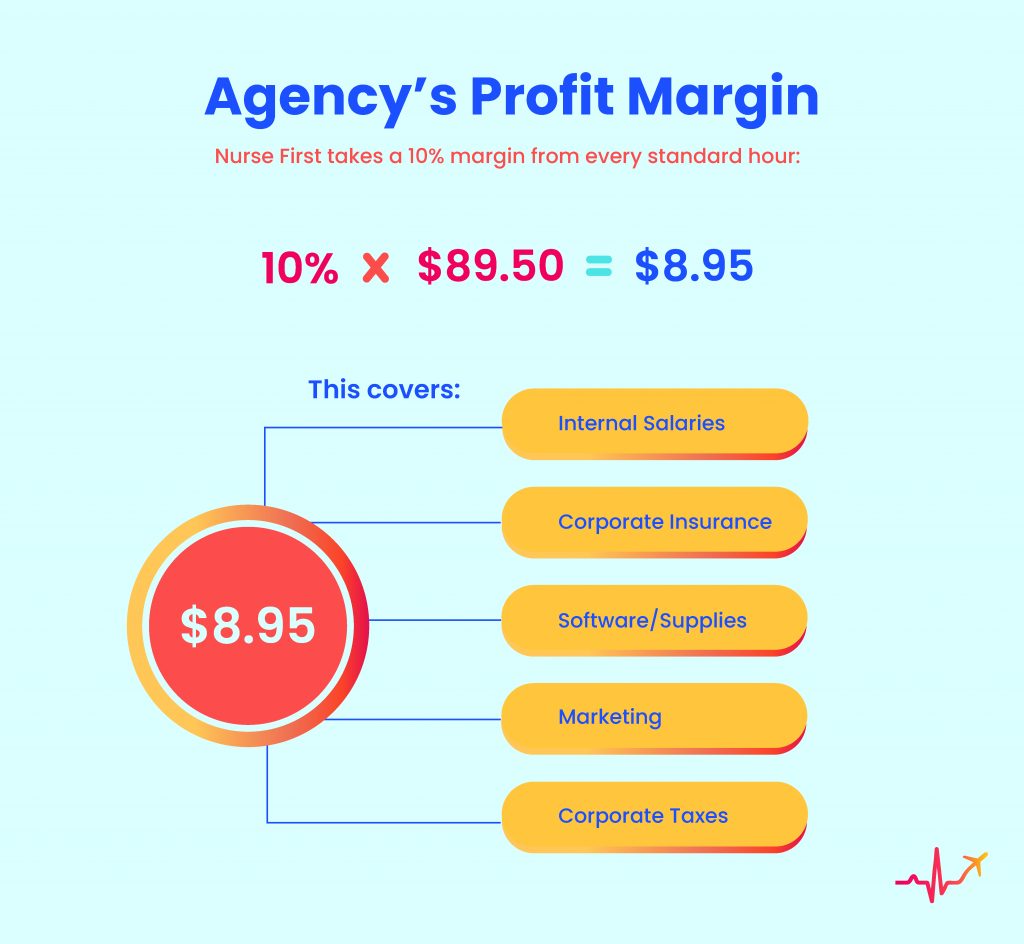

Travel Nurse Insight What Goes In To Pay Packages

10 for the first 9875 in taxable income.

. The higher earning potential of travel nursing in relation to tax advantages can seem like a no-brainer. Maintain a mileage Log and keep all your receipts. Have a permanent physical residence that you pay for and maintain.

You are a nurse. This is the most common Tax Questions of Travel Nurses we receive all year. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax.

There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements. Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient. Saving lives while not taking pee breaks.

Spend at least 30 days of the year in that place. To claim the tax benefits of being a travel nurse your tax home must fit these requirements. The tax implications and filing.

Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends. Dont work in one location for more than 12 months in a 24 Month period. 250 per week for meals and incidentals non-taxable.

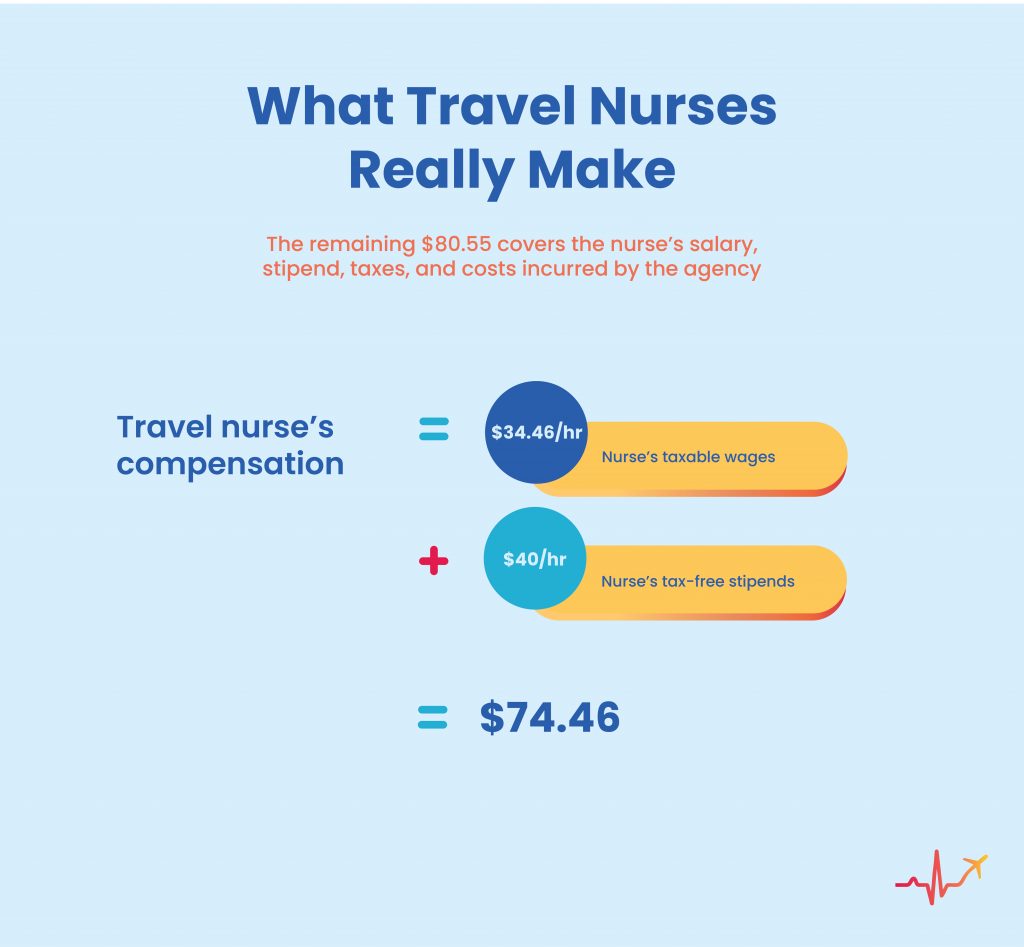

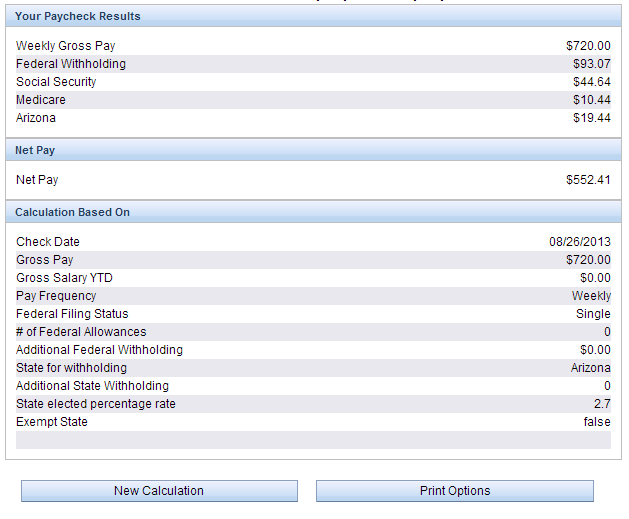

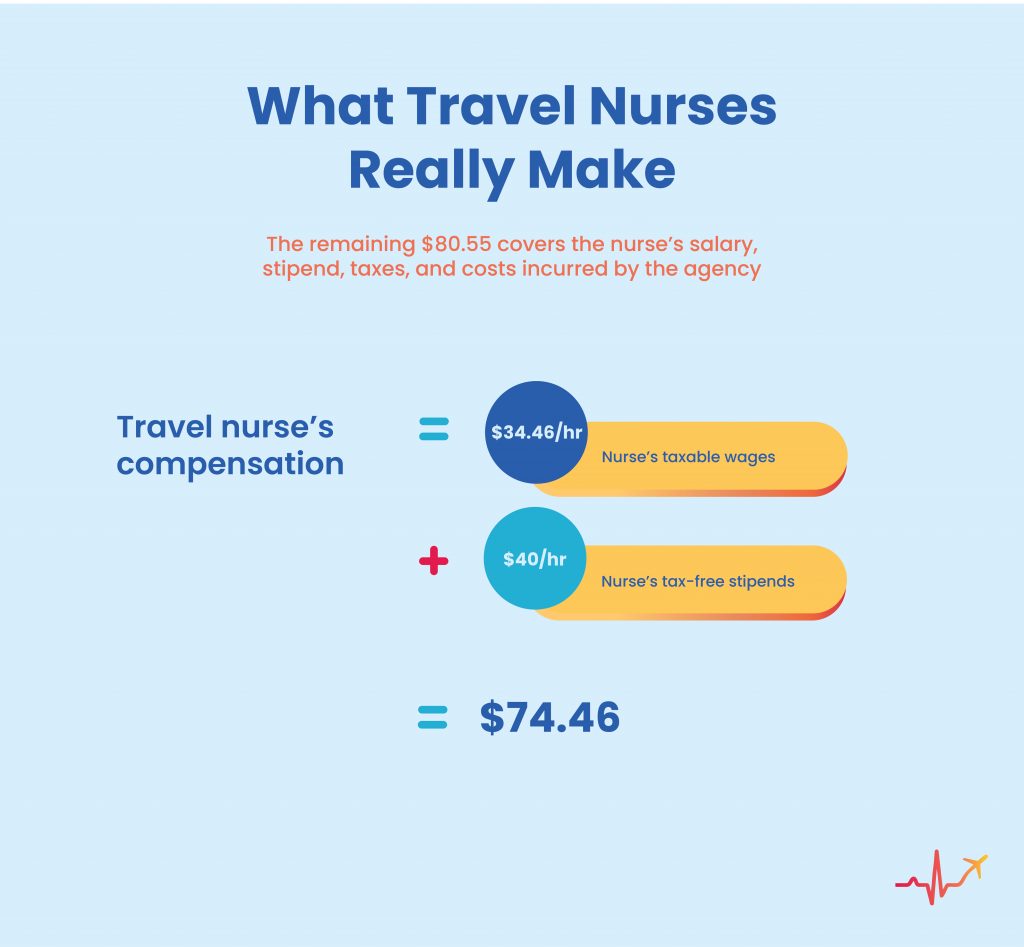

These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Travel nurses who are W-2 employees will pay taxes just like they would back home. As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract.

However your employer is allowed to pay an employee travel nurse a. 20 per hour taxable base rate that is reported to the IRS. For Sample 1 were looking at 720 16759 55241 68846 124087 net weekly pay.

Travel Nurse Tax Tip 1. 500 for travel reimbursement non-taxable. Due to the tax law changes back in 2018 you cant take any travel expense deductions.

You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable. However recently-licensed travel nurses tend to earn a much lower starting salary of 3771 while their more experienced counterparts earn an average of 8206. Keep hard copies of all contracts and paperwork.

Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for. Others can read this sites handy advice. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly.

One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or other basic expenses. Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses who maintain and pay for another residence while temporarily on travel assignment. You will owe both state where applicable and federal taxes like everyone else.

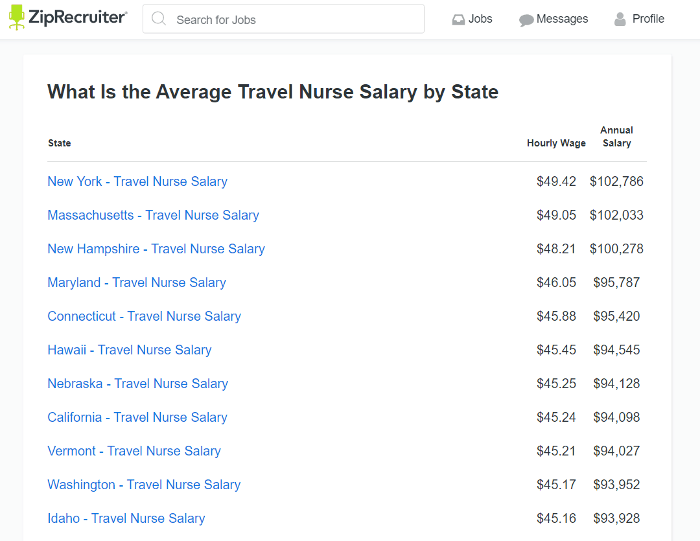

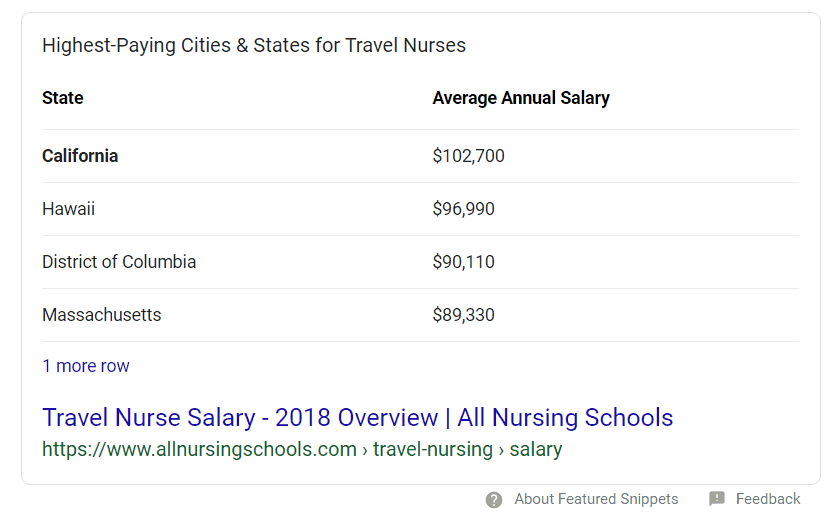

I could spend a long time on this but here is the 3-sentence definition. The average hourly rate for a travel nurse is 5649. Its prominent among both travel nurses and travel nursing recruiters.

Travel Nurse Tax Tip 2. This is typically done in the form of an expense report. Make sure you have paperwork proving your start and end dates to prove temporary work.

Here is an example of a typical pay package. Traditional full-time nurses receive a taxable salary from a single employer. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses.

What is a tax home. Bureau of Labor and Statistics. 2000 a month for lodging non-taxable.

Not just at tax time. Average Pay for Travel Nurses. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

If the travel nurse does not have a tax residence the reimbursement portion is supposed to be. Depending on travel location these practitioners can earn between 3000 and 7000 per week averaging a 36-hour work week. Travel Nurse Tax Tip 3.

You must have regular employment in the area. According to Vivian a healthcare jobs marketplace and the US. Yet a travel nurses pay generally consists of two main components.

You know travel nurses make more money. Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends. When doing proactive planning Willmann says its important to pay attention to your marginal tax rate.

State travel tax for Travel Nurses. The base rate is taxable but the reimbursements or allowances may be tax-exempt if youre working away from your tax home. Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing 2000 a month for lodging non-taxable.

As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. Then one day you start thinking about travel nursing. Thats the tax rate on one more dollar of.

24 for taxable income between 85526 and 163300. Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. Resources on tax rules for travelers and some key points.

Typically there are stipends or reimbursements for travel nurses. Some of this may include overtime hours though the availability and demand for overtime will vary from one assignment to. For more on travel nursing salaries check out Salary Explorer.

The History of Travel Nursing. Your hourly wages are taxable but these per diems are not. 1 A tax home is your main area.

12 for taxable income between 9876 and 40125. According to Vivian a healthcare jobs marketplace and the US. Due to the tax law changes back in 2018 you cant take any travel expense deductions.

The regular taxable hourly rate plus nontaxable reimbursements also called stipends subsidies allowances or per diem payments which are meant to cover meals and lodging. 22 for taxable income between 40126 and 85525. 4 must know rules to tax-free money as a travel nurse.

These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. This is how a lot of travel nurses handle taxes.

As you interview for and are offered travel nursing jobs pay close. Youve heard of it from co-workers you follow a few travel nurse Facebook pages but man its a little confusing. The average travel nurse salary varies greatly depending on the work assignment.

Purveyors of this rule claim that it allows travel nurses to accept tax-free.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

How To Calculate Travel Nursing Net Pay Bluepipes Blog

What Travel Nurses Ought To Know About The Cost Adjusted Value Of Their Pay Bluepipes Blog

How To File Your Taxes As A Travel Nurse Ioogo

What Is Travel Nursing Academia Labs

Travel Nurse Insight What Goes In To Pay Packages

How To Evaluate Travel Nursing Pay Packages On Facebook Bluepipes Blog

How To Read Understand Your Nurse Pay Stub Nurse Money Talk

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Salary Comparably

Travel Nurse Tax Deductions What You Need To Know For 2018

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To Make The Most Money As A Travel Nurse

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog